Pre-COVID, nearly two-thirds of Florida residents were found to have migrated to Florida from other states and one-fifth of those migrated from a foreign country. COVID changed the way we live and work. Remote work arrangements have made it unnecessary to be tied to a physical location. Since COVID, over 900 people move to Florida each day. People move to Florida for many reasons: the weather is beautiful, they want to move closer to family and friends, they are attracted to the business-friendly environment, etc. Tax isn’t always a first priority; however, it is a significant factor. Many strategies may be implemented to mitigate U.S. income and estate taxes before becoming a Florida resident and even after arrival. We invite you to attend our presentation covering the following international tax-related topics:

· U.S. Income Tax Residency

· Income Tax and Reporting Requirements for U.S. Residents

· Strategies for Remediating Potential Noncompliance

· U.S. Domiciliary Status for Estate Tax Purposes

· Estate Tax and Reporting Requirements for U.S. and Non-U.S. Domiciliaries

· Structuring Strategies to Mitigate Income and Estate Tax

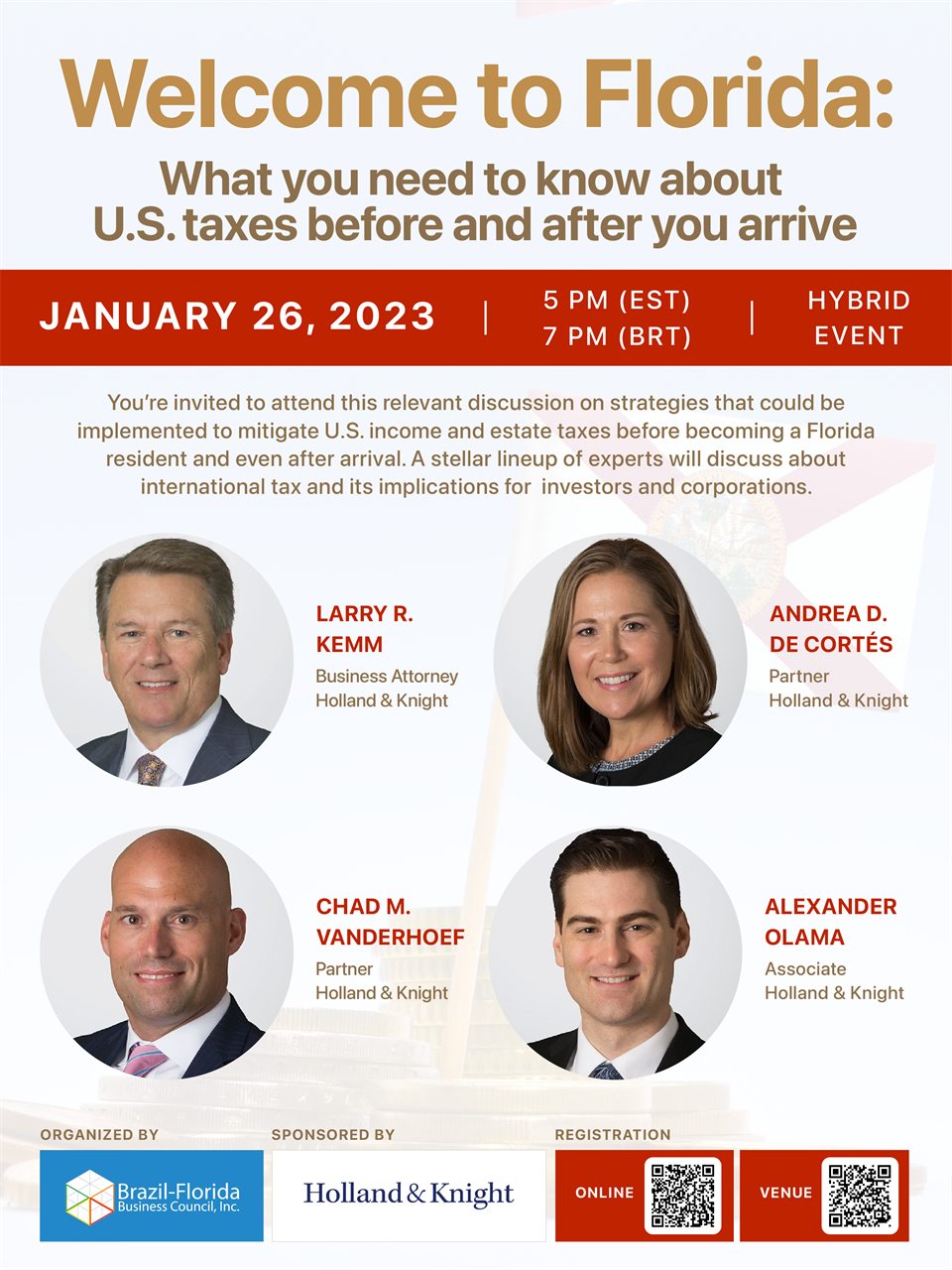

Panelists:

✅Larry R. Kemm is a business attorney in Holland & Knight's Tampa office who focuses on tax matters for domestic and international clients. With 35 years of combined practice as a tax lawyer and Certified Public Accountant (CPA), Mr. Kemm has vast experience advising clients in structuring domestic and international transactions and business operations in a tax-efficient manner, and in representing clients before the Internal Revenue Service (IRS) in tax.

✅Andrea Darling de Cortés, Partner of the Firm focuses her practice in the areas of inbound international income and estate tax planning, international tax controversy and compliance, cross-border tax planning and related transactional matters. She has advised clients on a broad array of tax and legal, transactional and operational matters, including U.S. income and estate tax planning for non-U.S. high-net-worth individuals with U.S. and non-U.S. assets, pre-U.S. residency tax planning, planning with respect to foreign investment in U.S. real property and U.S. trade or business analysis.

✅Chad M. Vanderhoef is a partner in Holland & Knight's Tampa office with many years of experience representing clients in a wide variety of international tax planning and tax controversy cases. Mr. Vanderhoef has served as counsel with respect to U.S. Tax Court, federal district court, and federal appellate court litigation, as well as Internal Revenue Service (IRS) appeals and examination cases. Mr. Vanderhoef provides tax advice to a U.S.- and foreign-based clients, focusing on corporations, high-net-worth individuals, and family offices.

✅Alexander Olama is an Associate in Holland & Knight's Tampa office with more than seven years of experience representing clients in a wide variety of international tax planning and tax controversy cases. Mr. Olama’s knowledge involves offshore tax compliance, including providing advice with respect to the Internal Revenue Service (IRS) Offshore Voluntary Disclosure Program (OVDP), IRS Streamlined Filing Compliance Procedures, Foreign Account Tax Compliance Act (FATCA), Report of Foreign Bank and Financial Accounts (FBAR), expatriation planning and cross-border tax matters.

This event will be hybrid. The in-person program includes a networking reception after the discussion. Space is limited.