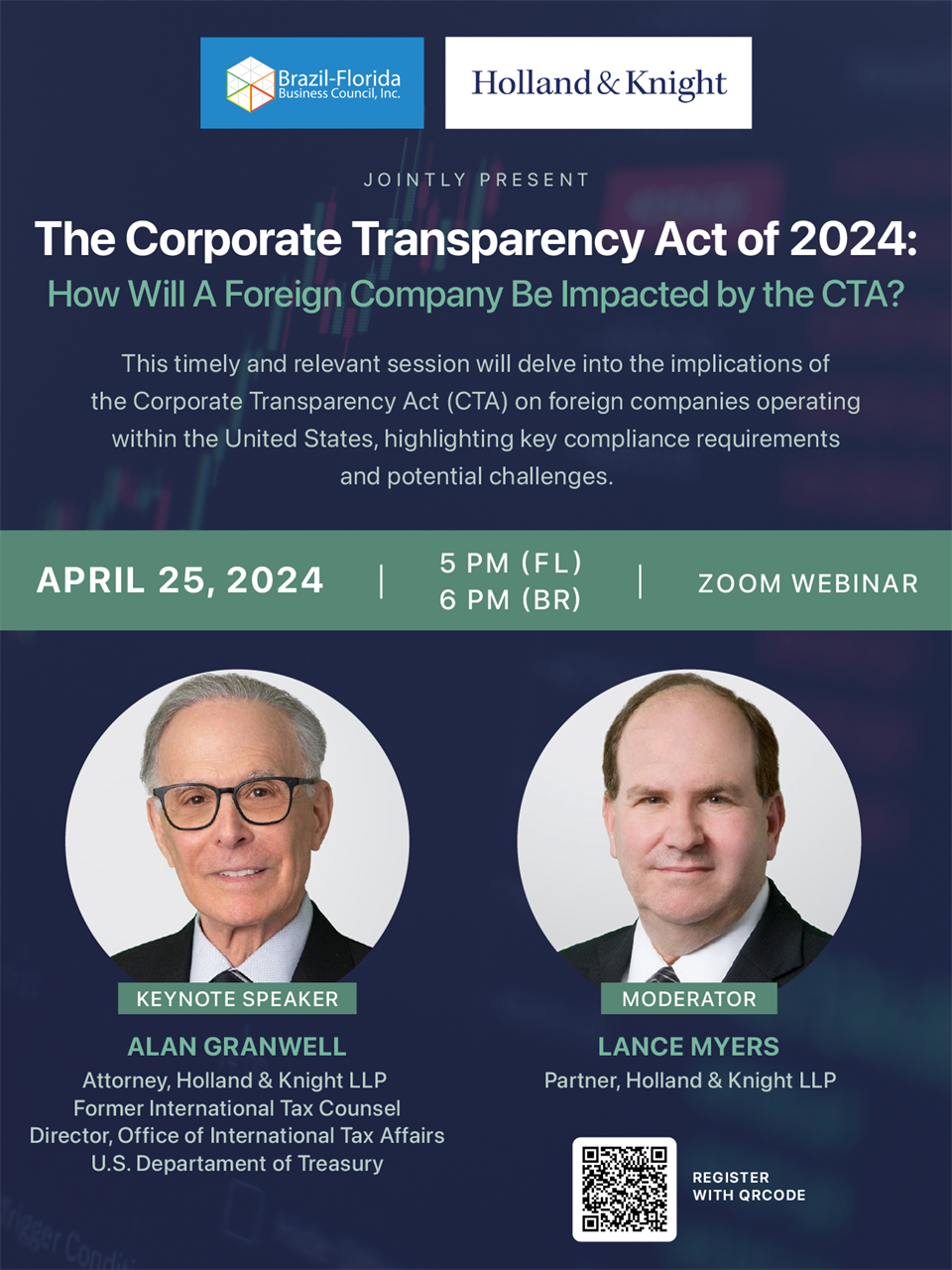

✅ ALAN GRANWELL is an attorney in Holland & Knight's Washington, D.C., office, with more than 50 years of experience in international taxation. In his long and wide-ranging career, he has represented multinational corporations and globally oriented high-net-worth clients in a broad array of international tax planning, compliance and controversy matters, including serving as an expert witness.

He also advises on tax transparency initiatives, including the Corporate Transparency Act (which will have widespread application to privately held companies and their beneficial owners), the Foreign Account Tax Compliance Act, the Common Reporting Standard and the U.S. Department of Justice Swiss Bank Program.

In the early 1980s, Mr. Granwell was the International Tax Counsel and Director, Office of International Tax Affairs, U.S. Department of the Treasury. In that capacity, Mr. Granwell was the senior international tax adviser at the Treasury Department and was responsible for advising the Assistant Secretary for Tax Policy on legislation, regulatory and administrative matters involving international taxation and directing the U.S. tax treaty program.

He began his career working at Wall Street law firms. He then moved to Washington, D.C., to accept his government appointment to work for the Treasury Department. Thereafter, he returned to private practice in Washington, D.C. Prior to joining Holland & Knight, Mr. Granwell was a tax attorney for a boutique international tax law firm.

Mr. Granwell is a Fellow of the American College of Tax Counsel and a well-known, frequent commentator and lecturer on international tax matters. He has authored numerous articles for publications, both in the United States and abroad. He has made presentations for the American Bar Association, Section of Taxation, the International Bar Association, the International Fiscal Association, the Society of Trust and Estate Practitioners (STEP) and other organizations in numerous countries around the world.

His academic credentials include: New York University School of Law, L.L.M.; Boston University School of Law, L.L.M.; Boston University School of Law, J.D.

✅LANCE MYERS is an attorney in Holland & Knight's New York office. He practices in the areas of corporate finance, public finance, corporate governance, securities and mergers and acquisitions. Mr. Myers has more than 34 years of experience in various business law areas. Mr. Myers represents issuers and underwriters in public and private offerings of securities, both equity and debt.

He also represents corporations and banks in securities offerings and control contests. He has significant mergers and acquisition experience, including acquiring and disposing publicly-held and privately-held businesses. Mr. Myers represents governmental agencies, corporations, educational institutions and underwriters in tax-exempt financings. He represents corporations in their public stock purchase plans and has set up internal codes of conduct to prevent and detect organizational misconduct. He also represents businesses in their restructuring of parent-subsidiary relationships.

Mr. Myers represents regulated entities such as public utilities and banks and has represented syndicators of public drilling and income funds. He represented KeySpan Energy Corporation and its then subsidiary, The Brooklyn Union Gas Company, in connection with its merger with The Long Island Lighting Company. Mr. Myers has been involved in numerous securitizations dealing with many industries.

He also has significant real estate experience in representing both landlords and tenants in leasing transactions, as well as organizing real estate investment trusts. Mr. Myers represents issuers, Boards of Directors and their Committees on corporate governance matters and has written and spoken on the subject of corporate governance, including various issues arising from the Sarbanes-Oxley Act of 2002.

Since 2005, he has been listed in "The Best Lawyers in America" and in 2005 and 2006 he was named in "The Best Lawyers in New York" edition of New York Magazine.